Identity theft, a prevalent form of cybercrime, encompasses a range of activities where an individual’s personal information is stolen and used fraudulently. One type involves the unauthorized acquisition and use of someone’s sensitive data, such as Social Security numbers or credit card details, to impersonate them and gain financial or personal benefits. This can manifest through various methods, each targeting different aspects of personal information.

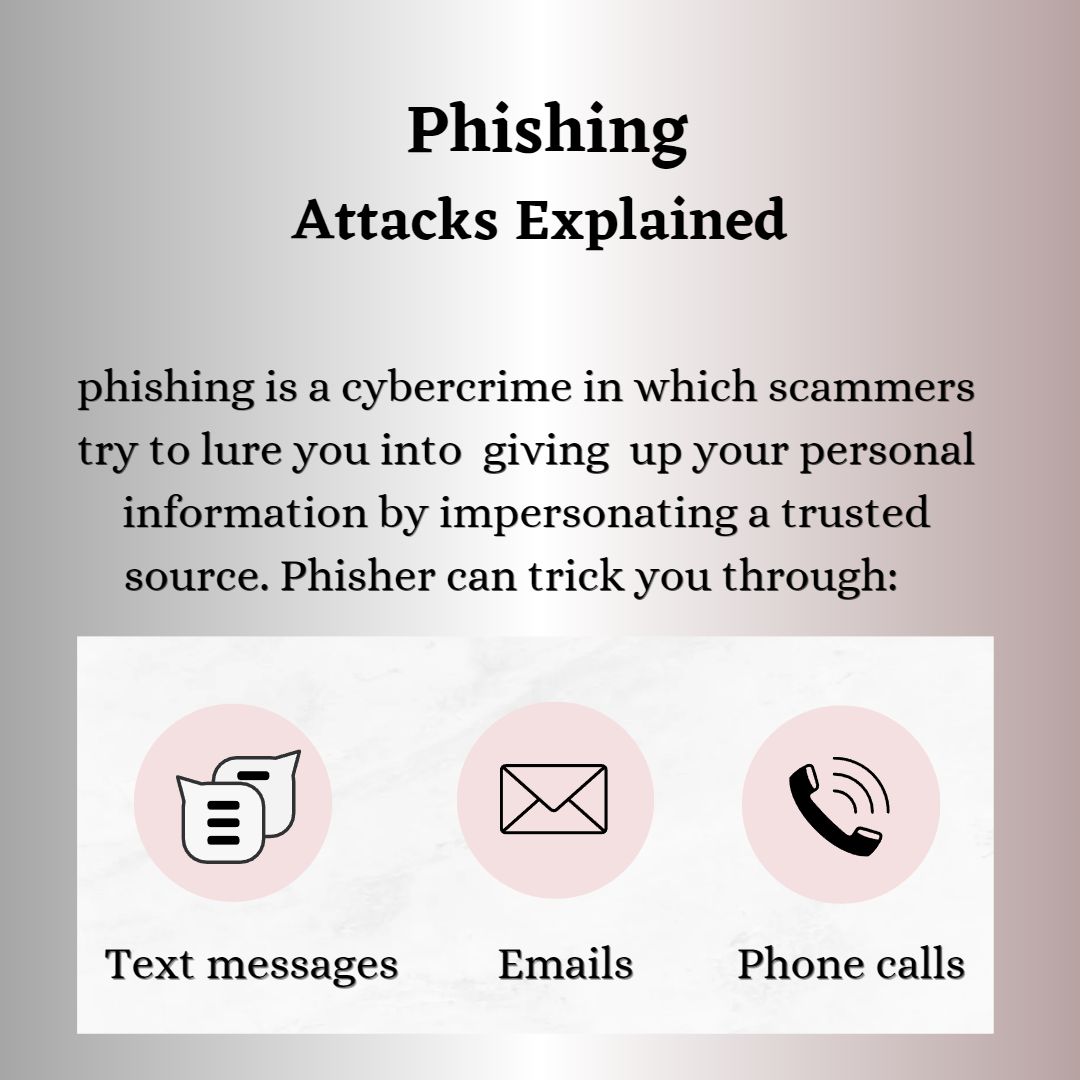

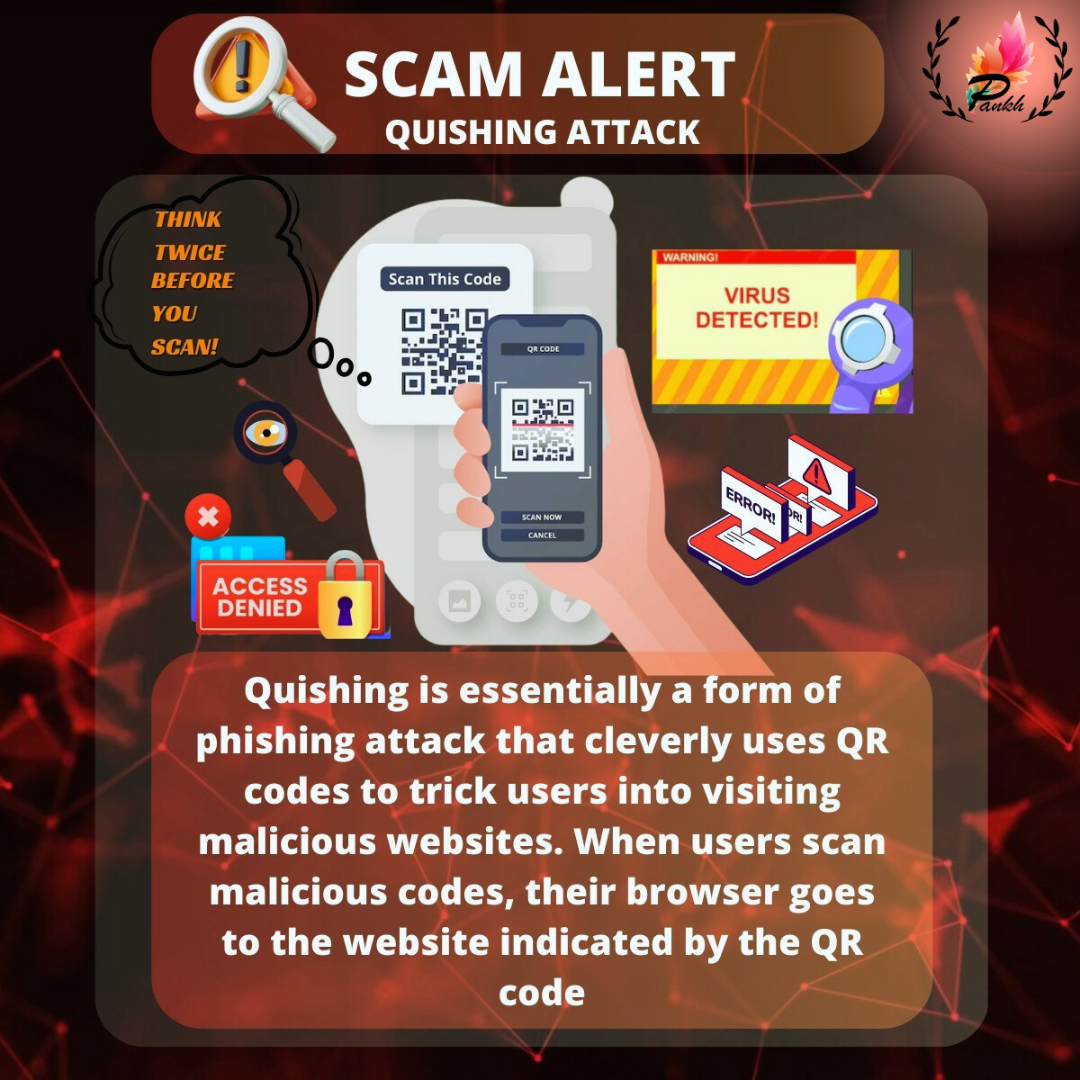

Phishing is a prevalent technique where cybercriminals deceive individuals via fraudulent emails, texts, or websites, tricking them into providing sensitive information. This often involves fake communications that appear to come from legitimate institutions, such as banks or online services. Another method is through data breaches, where hackers infiltrate an organization’s database to access large volumes of personal data, potentially exposing many individuals to identity theft.

How Identity Theft Happens

Identity theft can occur through various methods, each exploiting different vulnerabilities to access and misuse personal information. Here are ten common ways identity theft happens:

Phishing Scams: Cybercriminals use deceptive emails, messages, or websites that appear legitimate to trick individuals into disclosing sensitive information such as passwords, Social Security numbers, or credit card details. These communications often impersonate trusted organizations like banks or government agencies.

Data Breaches: Hackers infiltrate organizations’ databases or systems to steal large amounts of personal data. This stolen information, which can include names, Social Security numbers, and financial details, is often sold on the dark web or used directly for fraudulent activities.

Social Engineering: Attackers manipulate individuals into revealing personal information through deceitful tactics. This can involve pretending to be a trusted contact or creating a convincing scenario to obtain sensitive details, such as pretending to be a bank representative to verify account information.

Malware and Spyware: Malicious software installed on a victim’s device can capture keystrokes, take screenshots, or scan files to collect personal information without the user’s knowledge. This data is then used for identity theft or sold to other criminals.

Lost or Stolen Personal Items: Physical theft of personal items like wallets, credit cards, or smartphones can lead to identity theft. If these items contain sensitive information or can access personal accounts, thieves may use them to commit fraud.

Public Wi-Fi Vulnerabilities: Using unsecured public Wi-Fi networks can expose personal information to cybercriminals who intercept data transmitted over these networks. Attackers can capture login credentials, credit card numbers, and other sensitive information.

Skimming Devices: Criminals use skimming devices to illegally capture credit card or debit card information from unsuspecting individuals. These devices are often placed on ATMs or point-of-sale terminals and read the data from cards during legitimate transactions.

Data Theft from Shared Devices: Using shared or public computers, such as those in libraries or internet cafes, can expose personal information to others. If these devices are not properly secured, they may retain data or be used to access online accounts.

Social Media Exploitation: Cybercriminals can gather personal information from social media profiles, where individuals often share details like birthdays, addresses, and family members. This information can be used to guess passwords, answer security questions, or create convincing phishing schemes.

Mail Theft or Dumpster Diving: Thieves steal personal information from physical mail or trash. They may look for documents containing personal details, such as credit card statements, bank statements, or insurance paperwork, which can be used to commit identity theft.

Social engineering represents a more manipulative approach, where criminals use psychological tactics to convince individuals to divulge confidential information. This can involve impersonating trusted figures or creating deceptive scenarios to elicit personal details. Additionally, malware is a significant threat, as malicious software like keyloggers or spyware can infect devices, secretly capturing keystrokes and personal data for illicit use.

Methods of Theft

Identity theft can be executed through various sophisticated methods. Here are ten common methods used by criminals to steal personal information:

Phishing: Scammers send fraudulent emails, texts, or social media messages that appear to be from legitimate sources, such as banks or online services, tricking individuals into providing sensitive information like passwords or credit card numbers.

Spear Phishing: A targeted form of phishing where attackers personalize their messages to specific individuals or organizations, using information gathered from social media or other sources to make the phishing attempt more convincing.

Data Breaches: Hackers gain unauthorized access to an organization’s database, stealing large volumes of personal information such as names, Social Security numbers, and financial details. This data is often sold on the dark web or used for further fraudulent activities.

Malware: Malicious software, such as keyloggers or spyware, is installed on a victim’s device to secretly monitor and capture sensitive information, such as keystrokes, login credentials, and financial data.

Social Engineering: Attackers manipulate individuals into divulging personal information by using deceitful tactics, such as pretending to be a trusted authority or creating a fake emergency situation to gain access to confidential details.

Skimming: Criminals use skimming devices to capture information from credit or debit cards during legitimate transactions. These devices are often placed on ATMs, point-of-sale terminals, or gas station pumps to read card data.

Carding: The use of stolen credit card information to make unauthorized purchases or withdraw funds. Carders may test stolen card details in small transactions before using them for larger fraud.

Dumpster Diving: Thieves search through trash or recycling bins to find discarded documents containing personal information, such as bank statements, credit card offers, or medical records, which can be used to commit fraud.

Identity Cloning: Criminals use stolen personal information to create a new, fake identity. This can involve using real Social Security numbers with fictitious names or addresses to open accounts or obtain credit fraudulently.

Man-in-the-Middle Attacks: Attackers intercept and alter communications between two parties, such as between a user and a website, to capture sensitive information. This often occurs on unsecured or public Wi-Fi networks where attackers can monitor data transmission.

Financial Impact

The financial impact of identity theft due to cybercrime can be extensive and multifaceted, affecting victims in several significant ways. Here are key points outlining the financial consequences:

Unauthorized Transactions: Victims may face unauthorized charges on their credit cards or bank accounts. These fraudulent transactions can quickly accumulate, leading to substantial financial loss. Recovering these funds often requires time-consuming disputes and negotiations with financial institutions.

Credit Damage: Identity theft can severely damage a victim’s credit score. Fraudulent activities, such as unpaid loans or accounts opened in the victim’s name, can lead to a poor credit rating. This damage can make it difficult for victims to secure loans, mortgages, or even rental agreements.

Costs of Fraudulent Account Resolution: Resolving identity theft often incurs various costs, including fees for credit monitoring services, legal assistance, or administrative costs associated with disputing fraudulent accounts. These expenses can add up as victims work to clear their names and restore their financial health.

Loss of Savings: In cases where thieves gain access to bank accounts or retirement savings, victims may lose significant amounts of money. Recovering these funds can be challenging and may not always be possible, particularly if the theft involves complex financial transactions or investments.

Insurance Premium Increases: Some victims may experience increased insurance premiums as a result of identity theft. Insurance companies might raise rates for affected individuals due to the increased risk profile associated with identity theft incidents.

Employment and Income Disruptions: If identity theft affects a person’s credit or financial stability, it can impact their employment opportunities. Some employers conduct credit checks as part of their hiring process, and a damaged credit history can make it harder to secure a job or advance in a career.

Legal and Recovery Costs: Victims may incur legal fees if they need to take legal action to clear their names or rectify fraudulent activities. This includes hiring attorneys or paying for identity theft protection services, further straining their financial resources.

Spoofing is another tactic where attackers falsify identity elements such as email addresses, phone numbers, or websites to deceive individuals into sharing personal information. This method often involves creating a facade of legitimacy to gain the victim’s trust. In cases of credit card fraud, criminals use stolen credit card information to make unauthorized transactions or withdraw funds, resulting in financial loss and damage to the victim’s credit score.

Prevention Strategies

Preventing identity theft and cybercrime involves a proactive approach to safeguarding personal information and employing effective security measures. Here are key strategies to help protect yourself from identity theft:

Use Strong, Unique Passwords: Create complex passwords that are difficult for others to guess. Avoid using easily obtainable information like birthdays or common words. Use a combination of letters, numbers, and special characters, and ensure that each account has a unique password.

Enable Two-Factor Authentication (2FA): Add an extra layer of security by requiring a second form of verification, such as a code sent to your phone or an authentication app, in addition to your password. This helps protect your accounts even if your password is compromised.

Monitor Financial Statements Regularly: Regularly review your bank and credit card statements for any unauthorized transactions. Promptly report any suspicious activity to your financial institution to mitigate potential damage.

Check Your Credit Reports: Obtain and review your credit reports from major credit bureaus (Equifax, Experian, and TransUnion) at least annually. Look for any unfamiliar accounts or inquiries that could indicate fraudulent activity. You are entitled to one free credit report per year from each bureau.

Secure Your Devices: Use up-to-date antivirus and anti-malware software to protect your devices from malicious attacks. Ensure your operating system and applications are regularly updated with the latest security patches.

Be Cautious with Public Wi-Fi: Avoid conducting sensitive transactions, such as online banking or shopping, over public Wi-Fi networks. If necessary, use a virtual private network (VPN) to encrypt your internet connection and protect your data from interception.

Shred Sensitive Documents: Dispose of documents containing personal information, such as credit card statements, bank statements, and tax returns, by shredding them. This prevents identity thieves from accessing your information through discarded paperwork.

Secure Personal Information Online: Be mindful of the personal information you share on social media and other online platforms. Avoid posting details such as your full name, address, phone number, or financial information that could be exploited for identity theft.

Use Secure Websites: Ensure that websites where you enter personal or financial information are secure. Look for “https://” in the URL and a padlock icon in the address bar, which indicates that the site uses encryption to protect your data.

Place Fraud Alerts or Credit Freezes: If you suspect your information has been compromised, contact one of the major credit bureaus to place a fraud alert on your credit report. This makes it more difficult for identity thieves to open new accounts in your name. Alternatively, consider placing a credit freeze, which restricts access to your credit report and prevents new credit accounts from being opened.

Response to Theft

Responding promptly and effectively to identity theft is crucial to minimizing damage and resolving the situation. Here are steps to take if you become a victim of identity theft:

Report to Authorities: Immediately contact local law enforcement to file a police report. Having an official report on record can help you in dealing with creditors and disputing fraudulent transactions. Additionally, file a report with the Federal Trade Commission (FTC) in the U.S. through their IdentityTheft.gov website, which helps you create a recovery plan and provides a recovery affidavit.

Contact Financial Institutions: Notify your bank and credit card companies of the fraudulent activity. Request that they freeze or close affected accounts and dispute any unauthorized transactions. They can also assist you in monitoring your accounts for further suspicious activity.

Place Fraud Alerts: Contact one of the three major credit bureaus (Equifax, Experian, or TransUnion) to place a fraud alert on your credit reports. This alert notifies creditors to take extra steps to verify your identity before opening new accounts or extending credit.

Consider a Credit Freeze: If you’re concerned about further identity theft, consider placing a credit freeze with the major credit bureaus. A credit freeze restricts access to your credit report, making it more difficult for identity thieves to open new accounts in your name.

Review and Correct Your Credit Reports: Obtain and review copies of your credit reports from all three major credit bureaus. Look for any unfamiliar accounts or inquiries that may be fraudulent. Dispute any inaccuracies with the credit bureaus, providing evidence of fraud where applicable.

Notify the Relevant Agencies: If the identity theft involves tax fraud, contact the Internal Revenue Service (IRS) to report the issue. The IRS can help you address any fraudulent tax filings and correct your tax records.

Update Your Personal Information: Change passwords for all your online accounts, particularly those that might have been compromised. Use strong, unique passwords for each account and enable two-factor authentication where possible.

Monitor Your Accounts: Continue to monitor your financial accounts and credit reports regularly to detect any further suspicious activity. Consider subscribing to an identity theft protection service that offers credit monitoring, alerts, and identity restoration assistance.

Secure Your Personal Information: Review and improve your personal security practices. Secure your devices with updated antivirus software, use encrypted connections, and be cautious about sharing personal information online.

Keep Detailed Records: Document all communications and actions taken in response to the identity theft. This includes records of conversations with financial institutions, law enforcement, credit bureaus, and any other relevant parties. Keeping thorough records can assist in resolving disputes and tracking the progress of your recovery efforts.

Legal and Regulatory Measures

Legal and regulatory measures play a crucial role in combating identity theft and protecting individuals from cybercrime. These measures include laws, regulations, and frameworks designed to prevent identity theft, address its consequences, and provide support to victims. Here are some key legal and regulatory measures:

1. Identity Theft and Assumption Deterrence Act (ITADA)

The Identity Theft and Assumption Deterrence Act, enacted in the U.S. in 1998, makes identity theft a federal crime. It criminalizes the unauthorized use of someone else’s personal information to commit fraud or other crimes. Under this act, individuals convicted of identity theft can face significant penalties, including fines and imprisonment.

2. Fair Credit Reporting Act (FCRA)

The Fair Credit Reporting Act regulates how credit reporting agencies collect, use, and share consumer information. It provides consumers with the right to access their credit reports and dispute inaccuracies, including those resulting from identity theft. The FCRA mandates that credit bureaus investigate disputed items and correct any errors.

3. Gramm-Leach-Bliley Act (GLBA)

The Gramm-Leach-Bliley Act requires financial institutions to implement measures to protect the confidentiality and security of consumers’ personal financial information. It mandates the creation of privacy policies and safeguards to prevent unauthorized access to sensitive data, reducing the risk of identity theft in the financial sector.

4. California Consumer Privacy Act (CCPA)

The California Consumer Privacy Act, enacted in 2018, provides California residents with greater control over their personal information. It grants consumers the right to know what personal data is being collected, the purpose of its collection, and the ability to opt out of the sale of their data. The CCPA enhances consumer protection and addresses

Account takeover occurs when criminals gain unauthorized access to online accounts, such as email, banking, or social media profiles. This access can be used to commit further fraud, steal additional information, or manipulate the victim’s online presence. Medical identity theft involves using someone else’s personal information to obtain medical services or benefits, leading to fraudulent medical bills and potential complications in the victim’s medical records.

Synthetic identity theft involves creating a new identity by combining real and fictitious information. This can include using a genuine Social Security number with a fake name or address to open fraudulent accounts, making detection more challenging. Each type of identity theft presents unique risks and challenges, highlighting the importance of robust personal information protection and vigilance against various cyber threats.