Carding” in cybersecurity refers to the illegal activity of trafficking and using stolen credit card information to make unauthorized purchases or other fraudulent transactions. This cybercrime involves obtaining credit card details through various methods, including data breaches, phishing, skimming devices, or purchasing the information on the dark web. Carding is a form of cybercrime that involves the unauthorized use of stolen credit card information to make fraudulent transactions. This practice has evolved into a sophisticated and organized criminal activity, posing significant challenges for individuals, businesses, and financial institutions worldwide. Carding is not merely about making illegal purchases; it encompasses a wide range of activities, from the theft and sale of card data to the exploitation of vulnerabilities in payment systems.

Methods of Obtaining Card Data

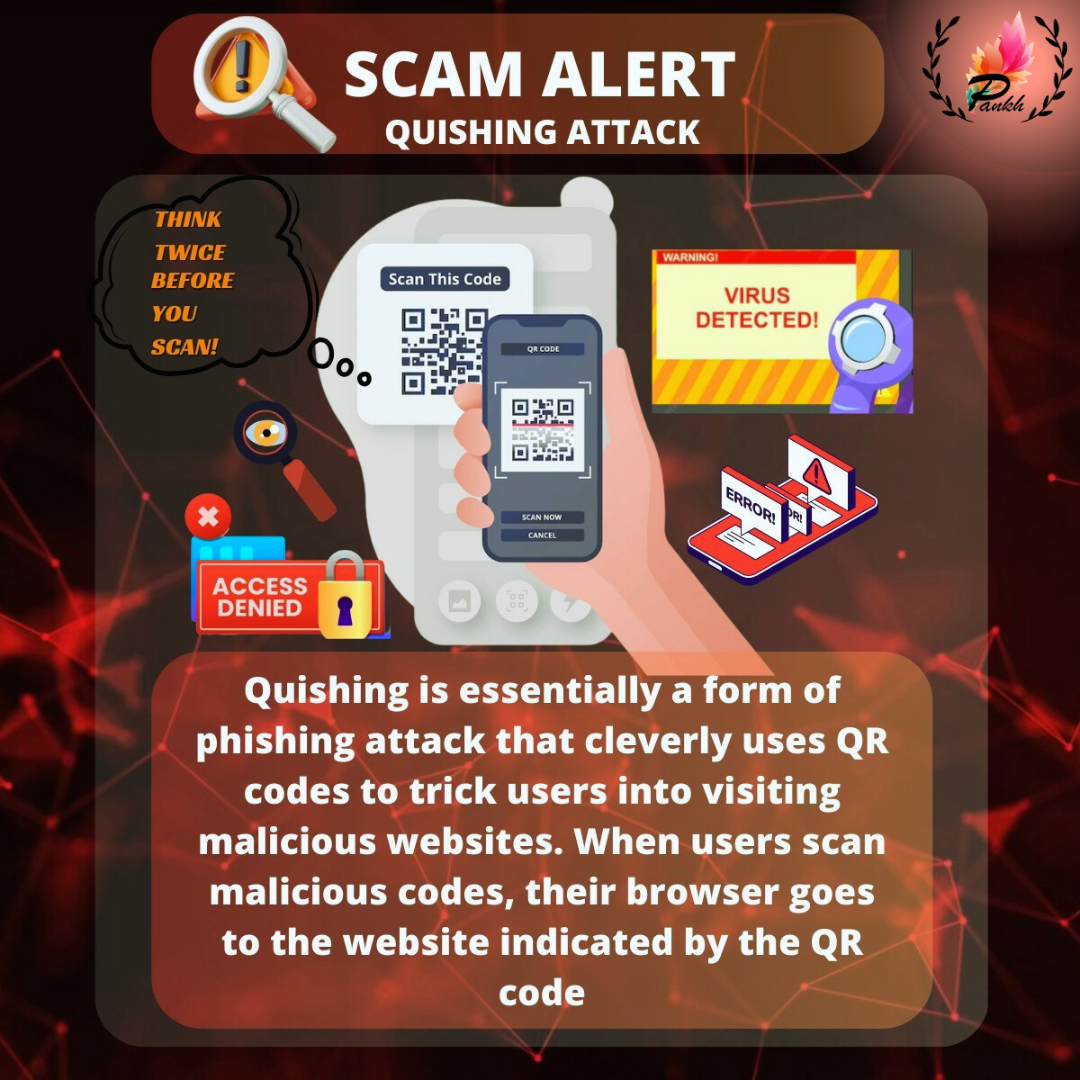

The foundation of carding lies in the acquisition of credit card details. Cybercriminals use various methods to obtain this sensitive information. Common techniques include data breaches, where hackers infiltrate systems of companies that store credit card information, and phishing attacks, where victims are tricked into providing their card details through deceptive emails or websites. Additionally, skimming devices placed on ATMs or point-of-sale systems can capture card data directly from physical cards. Another increasingly common method is through malware, where malicious software is used to harvest credit card information from compromised devices.

Carding is a type of cybercrime involving the use of stolen credit card information for fraudulent activities. Criminals obtain this information through various means, such as phishing, data breaches, or dark web markets. They then use the stolen card details to make unauthorized purchases or sell the information to other criminals. It poses significant risks to financial institutions and consumers, highlighting the importance of robust security measures and vigilance.

Carding Forums and Dark Web Marketplaces:

1. What are Carding Forums? Carding forums are online platforms where cybercriminals gather to discuss, share, and trade stolen credit card information. These forums are often hidden in the deep or dark web, making them inaccessible through regular search engines and requiring special browsers, like Tor, to access. They act as communities where participants can learn carding techniques, buy tools, and exchange experiences related to credit card fraud.

2. How Do Carding Marketplaces Operate? These marketplaces operate like typical e-commerce websites but for illicit goods and services. Sellers list stolen credit card data, often categorized by type, issuing bank, country, and card limits. Buyers can purchase this data using cryptocurrencies, such as Bitcoin, to maintain anonymity. Some platforms even offer “quality guarantees” or replacement policies if the purchased card data turns out to be invalid.

3. Types of Products and Services Available: Apart from stolen credit card data, these forums offer a wide range of illegal services and products, including:

- Fullz Packages: Complete sets of stolen personal information, including names, addresses, Social Security numbers, and more.

- Carding Bots and Tools: Software tools that help automate the process of testing and using stolen cards.

- Tutorials and Guides: Step-by-step instructions on how to use stolen credit cards for various fraudulent activities.

- Drops and Money Mule Services: Services that provide fake addresses or individuals to receive stolen goods purchased with the cards.

4. Access and Security Measures: Gaining access to these forums often requires an invitation or a referral from existing members. Many forums implement strict vetting processes to prevent infiltration by law enforcement. This includes requiring new users to prove their legitimacy by contributing valuable information or paying an entry fee. Advanced encryption and anonymity tools are employed to secure communications and transactions within these platforms.

5. The Role of Cryptocurrencies: Cryptocurrencies play a crucial role in these marketplaces by providing a relatively untraceable method of payment. Bitcoin, Monero, and other privacy-focused coins are commonly used for transactions, making it difficult for authorities to track the flow of money between buyers and sellers.

6. The Risks Involved: Engaging in carding is highly illegal and poses significant risks even for the criminals involved. Many forums are rife with scams, where buyers might pay for card information that turns out to be fake or already canceled. Additionally, these platforms are under constant scrutiny by law enforcement agencies, and users risk being caught, fined, or imprisoned.

7. Law Enforcement Efforts: Law enforcement agencies worldwide, such as the FBI and Europol, are actively working to infiltrate and dismantle these networks. Operations like these often involve undercover agents posing as buyers or sellers to gather intelligence and identify key players within the carding community. Successful takedowns of major forums can lead to the arrest of hundreds of individuals involved in carding activities.

8. Impact on Victims and Businesses: The impact of carding on victims and businesses is profound. For individuals, it can lead to financial loss, damaged credit scores, and long-term identity theft issues. Businesses face losses from chargebacks, increased security costs, and reputational damage. The broader financial ecosystem also suffers as trust in digital transactions diminishes.

9. Seeking Help and Consultancy: If you are concerned about the threat of carding to your business or personal finances, seeking professional cybersecurity consultancy can be crucial. Our organization offers specialized consultancy services to help protect against carding and other cyber threats. We provide tailored solutions, from implementing advanced fraud detection systems to conducting security audits that identify vulnerabilities in your payment processing systems.

For those interested in consultancy services, reach out to us here to learn more about how we can help safeguard your assets and information from cybercriminals.

Testing and Validation of Stolen Cards:

Once credit card information is obtained, carders often perform a validation process to determine if the card is still active and usable. This is typically done through “carding” small transactions, often with the help of automated bots, to test the validity of the card without drawing attention. For instance, a carder might use the stolen card to make a small purchase or donation. If the transaction goes through, it confirms the card’s usability, allowing the carder to proceed with larger, more profitable transactions.

Carding in cybersecurity refers to the illegal activity of using stolen credit card information to make unauthorized purchases or transactions. This typically involves obtaining card details through hacking, phishing, or buying them from dark web marketplaces. Carding can result in significant financial loss for victims and is a serious crime that involves identity theft and fraud. Cybersecurity measures aim to prevent carding by enhancing data protection and monitoring for suspicious activities.

Techniques and Tools Used in Carding:

1. Automated Carding Bots: One of the most common tools used in carding is automated bots. These bots are software programs designed to test stolen credit card information quickly and efficiently by attempting numerous small transactions on different websites. They automate the validation process, making it easy for carders to verify which cards are active and usable without manual input. By using these bots, carders can rapidly exploit valid cards for larger fraudulent transactions. To protect your business from such threats, explore our cybersecurity consultancy services for implementing advanced bot detection and mitigation strategies.

2. VPNs and Proxy Servers: Carders frequently use Virtual Private Networks (VPNs) and proxy servers to mask their IP addresses, making it difficult for law enforcement to trace their activities. These tools help cybercriminals appear as if they are operating from different locations, thereby evading geographic filters and fraud detection systems set by online retailers. Some sophisticated carders even use residential proxies, which are more difficult to detect as fraudulent compared to data center proxies. For businesses seeking to enhance their fraud detection capabilities against such methods, consult with our experts to implement cutting-edge location-based verification systems.

3. Remote Desktop Protocol (RDP) Exploits: RDP is often exploited in carding schemes, where carders purchase access to compromised computers around the world. By using these compromised systems, carders can conduct transactions that appear to originate from legitimate user devices, bypassing many security measures. These compromised systems are typically sold on dark web marketplaces, providing carders with an extra layer of anonymity. To mitigate the risks of RDP exploits, contact our team to learn about securing remote access points and implementing robust access control measures.

4. Fullz and Doxing: “Fullz” refers to a complete set of an individual’s personal information, including their full name, Social Security number, address, date of birth, and credit card details. Fullz packages are highly valued in carding communities as they provide all the information needed to commit identity theft or create synthetic identities for more extensive fraud. Doxing, or the practice of researching and publishing private information about an individual, often complements Fullz by enhancing the credibility of fraudulent transactions. For personalized security assessments and protection against such threats, reach out to our consultancy.

5. Phishing Kits and Social Engineering: Phishing kits are tools that allow carders to create convincing fake websites or emails that mimic legitimate businesses, tricking individuals into providing their credit card information. These kits often include templates for popular websites, making it easy for even less experienced criminals to launch phishing attacks. Social engineering tactics are also employed, where carders directly manipulate victims through phone calls or text messages. To better protect your organization against phishing and social engineering, consider our tailored phishing prevention services.

6. Carding Tutorials and Guides: The proliferation of carding is partly due to the extensive availability of tutorials and guides on carding forums. These resources offer step-by-step instructions on how to obtain, validate, and use stolen card information. They also provide advice on avoiding detection, such as which payment gateways have weaker security or which types of purchases are less likely to be flagged. This democratization of knowledge lowers the barrier to entry for would-be carders. Businesses can counteract these threats by educating their employees and customers; for comprehensive training programs, consult with our experts.

7. Skimming Devices and Point-of-Sale Attacks: Carders often use physical skimming devices attached to ATMs, gas station pumps, or other point-of-sale systems to capture card data directly from users. These devices are discreet and can clone card information when the card is swiped. Additionally, some carders deploy malware to POS systems to intercept card information during legitimate transactions. These methods highlight the importance of securing both digital and physical payment systems. To safeguard your payment infrastructure, get in touch with our consultancy for tailored security solutions.

8. Drop Services and Reshipping: After making fraudulent purchases, carders need a way to receive the goods without revealing their actual location. Drop services and reshipping schemes involve using intermediaries, known as “drops,” who receive stolen goods and forward them to the carder’s actual address, often overseas. These drops are sometimes unaware participants, recruited through job scams. Understanding and mitigating these tactics requires a deep knowledge of logistics and fraud detection; contact our team to explore strategies that can protect your business from being exploited in such schemes.

Impact on Businesses and Consumers:

The impact of carding on businesses and consumers is substantial. For businesses, carding can lead to significant financial losses due to chargebacks, where the merchant is held responsible for fraudulent transactions. It also damages the reputation of businesses, as customers lose trust in companies that fail to protect their payment information. For consumers, the effects of carding can range from unauthorized charges on their accounts to long-term credit damage if their information is used repeatedly or in identity theft schemes.

Prevention and Mitigation Strategies:

To combat carding, various strategies are employed by financial institutions, businesses, and consumers. Banks and payment processors use fraud detection systems that monitor transactions for unusual patterns, such as purchases in distant locations or multiple small transactions in a short time frame. Tokenization and encryption of card data help to protect information from being intercepted during transactions. For businesses, adhering to Payment Card Industry Data Security Standard (PCI DSS) guidelines is crucial for maintaining secure payment environments. Consumers are encouraged to monitor their account statements regularly, use credit cards rather than debit cards for online purchases, and employ multi-factor authentication when available.

Legal and Law Enforcement Efforts:

Law enforcement agencies around the world are actively working to combat carding through various means, including cybercrime task forces, international cooperation, and undercover operations to infiltrate carding forums. However, the anonymous and borderless nature of the internet makes it challenging to track down and prosecute carders. Legal frameworks are continually evolving to address these challenges, with some countries enacting stricter penalties for cybercrime and enhancing their capabilities to trace and shut down illegal operations.

The Future of Carding:

As cybersecurity measures improve, carders are continuously adapting their tactics. The rise of digital currencies, such as Bitcoin, has provided carders with a relatively anonymous way to conduct transactions, making the tracing of funds even more difficult. As technology evolves, so too will the methods of carding, necessitating ongoing advancements in cybersecurity defenses. Artificial intelligence and machine learning are increasingly being deployed to detect and prevent carding activities by analyzing transaction patterns and identifying anomalies in real-time.

Carding is a type of cybercrime involving the theft and fraudulent use of credit card information to make unauthorized purchases. It encompasses a range of illegal activities, from obtaining stolen card data to using it in online transactions. Carders acquire credit card details through methods such as data breaches, phishing, skimming devices, and malware attacks. This information is often traded on carding forums and dark web marketplaces, where criminals buy and sell stolen data, tools, and services.

The techniques used in carding are varied and sophisticated. Cybercriminals utilize automated bots to test the validity of stolen cards, use VPNs and proxy servers to hide their identities, and exploit remote desktop protocols (RDP) to mask their location. Fullz packages, which include detailed personal information of the cardholder, are particularly valuable for committing identity theft and enhancing fraudulent transactions. Phishing kits and social engineering tactics further aid carders in obtaining sensitive information directly from victims.

Carding forums are a critical component of this illicit ecosystem, serving as platforms where cybercriminals exchange tips, tutorials, and resources. These forums are often hosted on the dark web and require special access, making them challenging for law enforcement to penetrate. Cryptocurrencies like Bitcoin are commonly used for transactions within these forums, providing a layer of anonymity that complicates the tracking of illegal activities.

The impact of carding is far-reaching, affecting consumers through financial losses and identity theft, and burdening businesses with chargebacks, increased security costs, and reputational damage. To combat carding, organizations employ various security measures, including advanced fraud detection systems, multi-factor authentication, and regular monitoring of transaction patterns. However, as cybersecurity measures evolve, so too do the tactics of carders, making this an ongoing battle.

Law enforcement agencies are actively working to dismantle carding networks, often through undercover operations and international collaboration. Despite these efforts, the anonymous and borderless nature of the internet presents significant challenges in bringing carders to justice. Businesses and individuals alike are advised to remain vigilant and employ robust cybersecurity practices to protect against this persistent threat.

For professional assistance in defending against carding and other cyber threats, consulting with cybersecurity experts can provide tailored solutions and enhance security measures. Engaging in proactive defense strategies is essential to safeguarding personal and financial information from exploitation by cybercriminals.